Irs refund interest calculator

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

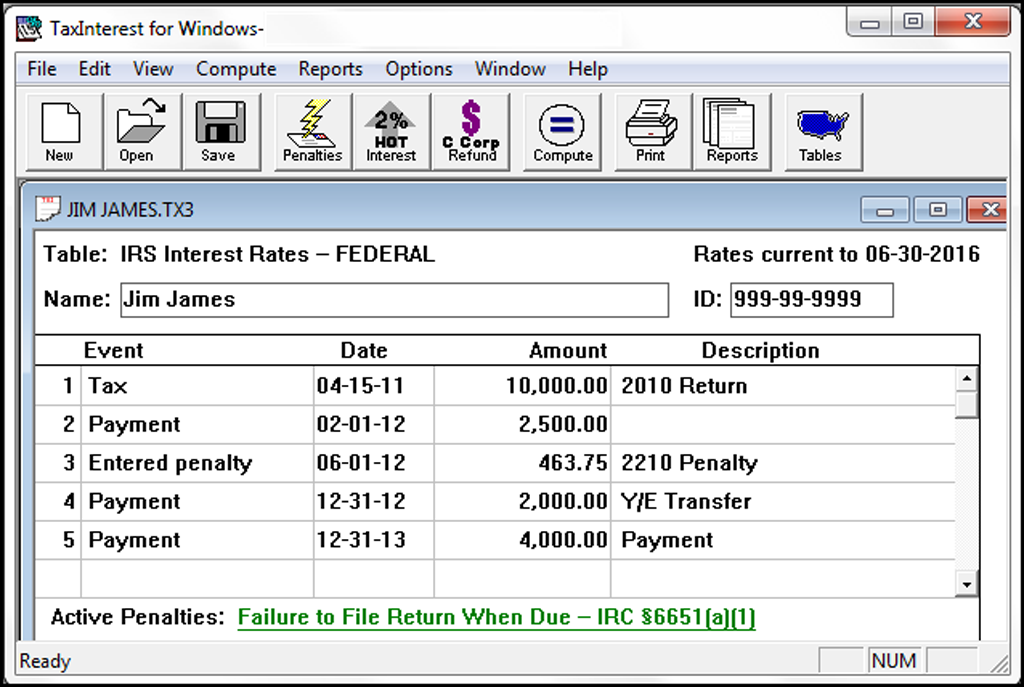

TaxInterest is the standard that helps you calculate the correct amounts.

. Were here for more than calculating your estimated tax refund. This is updated quarterly. If youre still waiting for a refund it generally will be accruing interest and the rate jumps to 5 on July 1 according to the IRS.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The IRS must process and pay returns within 45 days of the mid-April tax return due date. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

For help with interest. It is mainly intended for residents of the US. Most homeowners can deduct all of their mortgage interest.

It is not your tax refund. Contact your local Taxpayer. To calculate how much interest you could be due lets use the average refund amount so far for 2020 which the IRS says is 2767.

The interest calculation is initialized with the amount due of. The agency tacks on interest if it. This IRS overpayment interest calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates of IRS interest on tax.

Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar quarter plus. Figures based on the Federal IRS. Approval and loan amount.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. And is based on the tax brackets of 2021. If that refund payment is late by 30 days.

So for a 1000 refund you would get around 333 of interest for every month or 40 per annum your refund is delayed for 45 days or more beyond. Please pick two dates enter an amount owed to the IRS and click Calculate. But theres a little good news if youre missing a refund.

Up to 10 cash back TaxSlayer is here for you. If youve waited for 45 or more days you will see that amount in your refund. IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment balances.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. The IRS paid 136 billion in interest last year on the refunds. The interest rate the IRS will pay with right now is sitting at 4.

Call the phone number listed on the top right-hand side of the notice. Download or Email IRS 8404 More Fillable Forms Register and Subscribe Now. Due to delays some taxpayers will wait much longer for their refunds.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Refund interest payments have been an ongoing issue for the IRS in the past several years the authors said. The IRS will start paying 5 percent in guaranteed interest to individuals with delayed tax returns beginning in July up a percentage.

Nearly 16 million taxpayers will automatically receive more than 12 billion in refunds or credits. The IRS is also refunding many penalties if you already paid. If it has been at least 21 days since you e-filed or more than six weeks since you mailed your paper return you can check on your refund by calling the IRS at 1-800-829-1040.

You may be earning interest on your unpaid balance and the rate jumps to 6 from 5 on Oct. If youre still waiting by the end of the. This calculator is for 2022 Tax Returns due in 2023.

Prepare and e-File your. This is an optional tax refund-related loan from MetaBank NA. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up.

1 according to the. It will be updated with 2023 tax year data as soon the data is available from the IRS. By Tobias Burns - 052022 1206 PM ET.

Filing with us is as easy as using this calculator well do the hard work. If not it is. 39 rows IRS Interest Calculator.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Loans are offered in amounts of 250 500 750 1250 or 3500.

Mortgage Tax Deduction Calculator Freeandclear

How To Estimate Your Tax Refund Lovetoknow

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs State Interest Calculator Tax Software Information

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Interest On Income Tax Refund Meaning Eligibility And Calculation

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Easiest Irs Interest Calculator With Monthly Calculation

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Income Tax Refund Will You Lose Your Refund If You Missed Deadline Marca

Irs Pays 3 Billion In Late Refund Interest The Washington Post

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

20 2 5 Interest On Underpayments Internal Revenue Service

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros